RBI Governor announce Cardless Cash withdrawn to be available at all ATMs via UPI

RBI Governor announce Cardless Cash withdrawn to be available at all ATMs via UPI

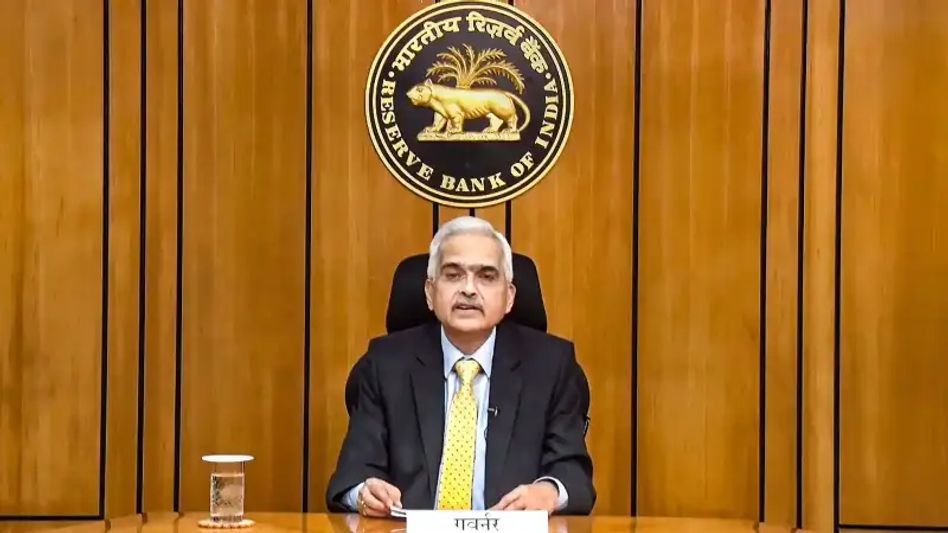

RBI Governor announce Cardless Cash withdrawn to be available at all ATMs via UPIReserve Bank of India (RBI), governor Shaktikanta Das on Friday, April 8 announced that the RBI has proposed to make cardless cash withdrawal facility available at all ATMs across all banks in India.

The RBI governor was announcing decisions made at the three-day Monetary Policy Committee meet. Das said that the facility is proposed to be made available through the Unified Payments Interface or UPI.

“At present, the facility of cardless cash withdrawal through ATMs is limited only to a few banks. It is now proposed to make cardless cash withdrawal facility available across all banks and ATM networks using the UPI,” Das said while making the announcement.

“In addition to enhancing ease of transactions, the absence of the need for physical cards for such transactions would help prevent frauds such as card skimming, card cloning, etc,” the RBI governor added.

The use of UPI enables customer verification while settling such transactions, Nitin Mathur, CEO of Tavaga Advisory Services, said after the announcement. “This is a step toward digitalizing banking and can significantly reduce fraudulent transactions even though the monthly limit allowed is a bit restrictive. Rise in digitalization and adoption of digital banking channels has exposed the system to several frauds and cyber crimes. It is thus important to ensure that these systems are not just efficient but also protected from emerging cyber security risks,” he said.

Copyright©2026 Living Media India Limited. For reprint rights: Syndications Today